EMI: Rather than depleting your hard-earned savings, it is better to take out a loan to cover large financial expenses such as a wedding, home renovation, or any emergency expense. Applying for a loan from a bank or lending institution also allows you to repay it over time in regular installments known as equated monthly installments (EMIs). For example, buying a home requires a significant investment, and taking out a home loan allows you to take advantage of not only various tax breaks but also the flexibility of paying EMIs.

In an age of rising inflation, the facility of EMIs allows you to remain stress-free by removing the burden of making lump-sum payments for large purchases and instead of easing things by letting you know the exact amount to be paid on a regular basis without burning a hole in your pocket.

What is an EMI?

An equated monthly installment (EMI) is a fixed amount of money paid to a bank or lender as part of the repayment of an outstanding loan over a set period of time.

Simply put, EMI is a facility that banks and other financial institutions offer to their customers that allows them to borrow a loan amount to meet immediate cash flow needs and then repay it in installments at a fixed rate of interest over a set loan term. Every calendar month, the customer is required to make these payments on a specific date. The EMI amount can be paid by cheque or through an online mode such as the auto-debit facility.

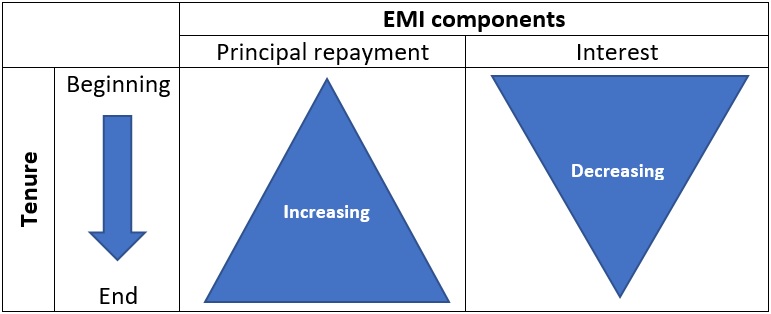

Components of EMI

An EMI consists of two parts: principal repayment and interest. During the first few years, the interest amount accounts for a sizable portion of the EMI. However, near the end of the loan term, the principal amount accounts for the majority of the EMI payment, with the interest cost accounting for a smaller portion.

What is the amortization schedule?

The amortization schedule is a comprehensive table that shows the entire loan details, as well as a breakdown of the EMI payments. It shows the principal and interest for each payment. This schedule aids in understanding how the loan progresses over its term.

The repayment table will include information such as scheduled payments, borrowed principal, and interest expense for each scheduled payment. It is beneficial to understand how the loan works as well as the interest-related details for claiming tax benefits.

How is EMI calculated?

The EMI calculation formula is as follows:

EMI = P × r × (1 + r) ^ n / ((1 + r) ^ n – 1)

Where,

P = Loan amount.

r = Rate of interest, which is calculated on a monthly basis.

n = Loan tenure (in months).

Let us understand by taking the following example:

Vinay has taken a loan of principal amount Rs 5 lakhs at an interest rate of 12% and a loan tenure of three years. The EMI will be calculated based on the formula mentioned above.

| Principal Amount (in Rs) | 5 lakhs |

| Interest rate (%) | 12% |

| Tenure (in months) | 36 |

| EMI payable (in Rs) | 16,607 |

Factors that affect EMI

Here are the major factors that impact the EMI:

Principal loan amount: It is the initial loan amount borrowed from a bank or lender by an individual. It is the most important factor in determining the EMI amount. As the principal amount increases, so does the EMI.

Rate of interest: It is the interest rate charged by banks or financial institutions for loan repayment. The rate is determined using various calculations and an evaluation of the borrower’s credit profile.

Loan tenure: The loan tenure refers to the time frame in which the borrower must repay the entire loan, including interest. If you have a longer-term, you will have to pay more interest to the bank or lender.

What are the types of loan interest rates?

Loan interest rates are of the following types:

Fixed interest rate: In this case, the interest rate remains constant throughout the loan’s term. As a result, the loan EMI remains unchanged. Fixed interest rates are typically 1% to 2% higher than current floating interest rates. However, because the interest rate does not fluctuate, you will have a good idea of your future EMI payments.

Floating or variable interest rate: In the case of floating interest rates, the interest rate is subject to change based on market conditions. A lender’s base rate determines the interest rate. As a result, if the base rate changes, the interest rates change automatically.

Should you opt for a fixed interest rate or floating interest rate?

Since fixed interest rates keep you relaxed about the EMI payments, the amount of which remains constant, you can choose it because it will provide you with a sense of certainty about your payments, especially if you do not want to take the risks of rising interest rates. It is ideal if the loan term is between three and ten years.

If the loan is for a long period of time, such as 20 or 30 years, a floating interest rate is preferable. When you know that the base rate will remain constant or low for an extended period of time, choose a floating interest rate. You can save a lot of money by planning for prepayments and lowering the total interest on your loan.

Does EMI change during the loan tenure?

A loan’s equated monthly installment, or EMI, is based on variables like loan amount, rate, and tenure. However, depending on certain conditions, the amount you must pay as EMI may vary over the course of the loan’s term.

We discuss them below:

Floating interest rate: In the case of fixed-rate loans, the EMI remains constant. If, on the other hand, one chooses a floating interest rate, the interest rate will be subject to change as the market scenario changes. As a result, it will have an effect on your equated monthly installment.

Prepayment of loan: Many banks allow you to pay off a portion of your loan in one lump sum ahead of schedule. By prepaying the loan, the principal amount decreases, lowering the equated monthly installment amount payable. Prepayment allows a person to save money on interest.

Progressive EMIs: Some lending institutions offer the option of repaying the loan in installments. For a certain period, you must pay an equated monthly installment, then the amount increases. It usually occurs in the case of long-term loans.

What is an EMI calculator?

Calculate monthly installments by entering loan tenure, interest rate, and loan amount into the EMI calculator. Borrowers can use the tool to determine the actual EMI amount due each month. To name a few, EMI calculators include personal loan EMI calculators, home loan EMI calculators, and education loan EMI calculators.

ALSO READ: Home Loan EMI How To Pay It Off If You lose Your Job Due To Pandemic?

Benefits of using an EMI calculator:

Financial planning: The online EMI calculator is useful because it helps you understand your monthly outgoings and simplifies your financial planning for other investments.

Accuracy: So the calculations are computerized, you can be confident that the results are correct and that you will receive an exact figure for the amount owed to the lender.

Accessible: There is no need to visit a bank because this online calculator is a convenient tool that can be accessed at your leisure, anywhere, and at any time.

Time-saving: While it eliminates the need for manual calculations, the online EMI calculator provides instant results on how much your loan will cost, saving you time.

Ease of comparison: You have the advantage of being able to compare various loan offers. You can make an informed decision by entering the required loan amount and tenure options and experimenting with various combinations.