Home loan EMI how would a person pay it if they lose their job? well As the second wave of the Coronavirus pandemic takes massive proportions (India is currently reporting around four lakh new infections and more than 3,000 deaths on a daily basis), those who service long-term loans, such as home loans, have additional reasons to be concerned, in addition to staying safe during this crisis. How would a person pay their home loan EMIs if they lost their job?

In India, home buyers rely heavily on housing finance to make a purchase. As a result of the devastating effects of the COVID-19 pandemic, many buyers are under tremendous pressure.

According to the Centre for Monitoring Indian Economy, the second wave of COVID-19 and the resulting lockdowns have impacted over 75 lakh jobs, raising the unemployment rate to a four-month high of 8% in April 2021.

Is there anything a potential Indian home buyer can do if the Coronavirus crisis has adversely affected his income sources?

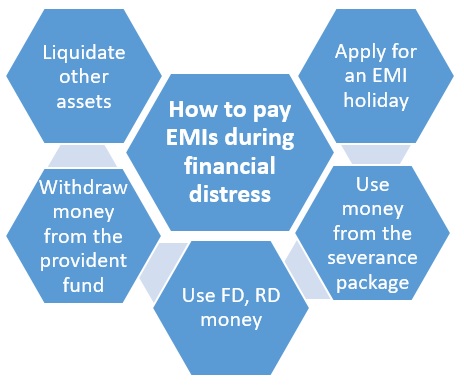

A home loan borrower should ideally include at least six months’ worth of EMI in his emergency fund. If the borrower ends up losing their job, he or she could continue making EMI payments. However, what if you have not? Mentioned below are some options.

Opt for EMI holiday, if available

In the aftermath of the COVID-19, the RBI announced major relief to home loan borrowers on March 27, 2020, deferring EMI payments under a three-month moratorium period in addition to lowering the repo rate to an all-time low of 4%.To provide more cushion, the RBI extended the loan moratorium by several months. For the period between March and August 2020, the RBI also advised banks not to classify late payments on long-term loans as non-performing.

Moratorium 2.0

While the industry anticipates the apex bank announcing ‘Moratorium 2.0′ in the aftermath of the economic shock caused by the second wave of the pandemic in India, the RBI is of a different mind, at least for the time being. As of April 2021, RBI governor Shaktikanta Das said a loan repayment moratorium was not needed, as businesses were well-prepared to deal with the situation. Das clarified that the central bank would not react in a hasty manner to a situation, saying, “We will watch a situation, its depth, gravity, and impact, before taking a decision.”

If the RBI launches such a program, the beneficiaries must keep certain things in mind. To begin with, it is not an EMI holiday; you will have to pay the money back later, with interest. A moratorium simply means that you have received a few months of relief from the RBI, with the late payment not being recorded as a ‘default’ in your credit history. Furthermore, whether or not the benefit is extended to you is at the discretion of your lender, as is the interest charged for late EMI payments.

Assume your monthly home loan payment is Rs 40,000. If this amount is not paid, it will be added to the loan principal. The interest on the outstanding loan, as well as Rs 40,000, will be calculated in the coming month.

Not taking this option is not an option for a borrower who has lost his or her job. “While taking advantage of the moratorium will incur additional interest costs, it will provide them with at least a two-month window to find work or arrange funds from other sources without negatively impacting their credit score,” says Chaudhary.

Money from severance package

Use the money from your severance package: Once a moratorium period expires, a borrower must arrange the funds to pay his home loan EMIs or face the usual consequences – the default would be noted in your credit history, and the bank would charge a penalty on each default, in addition to the interest.

At this point, you may have to make the payment with money from your severance package. Your notice period is technically equal to the number of months specified in your job contract. Your severance package includes two months’ salary if the notice period is two months. It is important for the time being to be cautious with the money you have. If you are unable to find a job while using this money to pay off your mortgage, consider other options.

Use Fixed Deposit (FD), Recurring Deposit (RD) money

Use your savings: You could also use your FD and RD to make the EMI payment because the interest you currently get on these (SBI FD interest is 5 percent -5.5 percent for one-year tenure, at the moment) is much less than the interest you would pay on home loans (SBI home loan interest rate on a loan size of Rs 30 lakhs is 6.7 percent), especially if you default.

Those who have neglected to include home loan EMIs in their emergency fund can redeem their existing fixed-income investments that have no connection to any critical financial goals, such as a retirement corpus or a children’s education fund.

Withdraw from Provident Fund (PF)

Use your provident fund money as follows: Following a 21-day lockdown, the Labour Ministry allowed the Employees’ Provident Fund Organization (EPFO60 )’s a million subscribers to withdraw a portion of their retirement savings on March 29, 2020, via a notification. Subscribers can withdraw up to three months’ basic salary and dearness allowance (DA) or 75 percent of their savings from their PF account, whichever is less. Finding another source of income can allow you to make your home loan payment for several months. The best part of the plan is that you can withdraw your PF money within three days.

Liquidate assets

Sell gold and liquidate debt instruments: At this point, investments in various debt instruments can be liquidated in order to pay off the home loan. You could also pledge gold and jewelry to secure funds for your home loan EMI payment. With gold prices hitting new lows on a daily basis in the aftermath of the pandemic, you might not get what you expected from the yellow metal – on May 3, 2021, the gold rate for one gram of 22-carat gold was Rs 4,416, a Rs 31 decrease from April 30, 2021.

You could also consider selling non-essential items such as automobiles, furniture, and electronics.

The interest rates on a loan against gold start at 7.25 percent and rise to 18 percent a year. Banks would process the loan request quickly because it is a secured loan.

Taking an equity position and touching it would lead to actual losses according to Chaudhary. “The ongoing equity market correction would have already reduced their portfolios by at least 30%.”

Borrow from family, friends

Seek family support: Another option is to borrow from family members and friends who are in a position to lend you money for the time being. This option is advantageous for the following reasons:

- On the amount borrowed, you will not pay interest.

- In comparison to a bank, you will have more willing and less scrutinising lenders.

- You will not accrue penalty on the interest that you are not able to repay within a specified time.

However, be realistic about the timeline for returning the money, as you run the risk of stressing your personal relationship.

ALSO READ: Looking For Your First Home? Here Are Some Basic Steps

Loan against insurance policy

If you need to borrow money and have no other options, your life insurance policy may come in handy. You can take out a loan against your insurance policy. The insurer can disburse the loan quickly (because it has all your information), and the balance is fairly low. An insurance policy loan has a lower interest rate than a personal loan.

Things home buyers should not do if they are paying EMI

Here are certain things that you should not do, as you deal with tough times in your life:

Avoid the lender: The borrower’s first step should be to notify the bank of any job loss. Avoiding them at this point would be the worst thing you could do. Genuine borrowers would have no trouble convincing the bank to refinance the loan. One way to reduce the EMI amount is to extend the loan term.

Expect a salary increase: Finding a job in a bad job market can be a difficult process. You should not reject a job that pays less than or equal to your previous salary package. Keep in mind that this is only for the time being. When things return to normal, you might be able to find a job that matches your skills and profile.