Two major segments of Indian real estate sector are on opposing paths of recovery, according to March quarter data from a slew of property-research firms. Whereas the residential phase experienced healthy progress, the workplace phase remained unimpressive. However, with the second wave of the coronavirus sweeping through India and forcing lockdowns, these levels of recovery are likely to be examined.

The graphs for each residential and workplace segment had curved upward from the troughs of the June 2020 lockdown-induced quarter. Home sales in tier-I and tier-II cities, which are typically covered by research firms, increased significantly. This was pushed by factors such as a reduction in stamp duty by some states (Maharashtra and Karnataka), low home-loan rates, and reductions from builders on top of static or declining costs.

Along with differences in their protection, the growth figures provided by the major research firms differ greatly. Anarock put Indian real estate sector at 29 percent year on year for the March 2021 quarter, while Knight Frank put it at 44 percent. However, each figure indicates that the residential sector was recovering and experiencing higher gross sales than in the pre-pandemic period.

During the workplace phase, while progress was underway, it was still a long way off. Jones Lang LaSalle predicted that internet absorptions (new space taken up minus old space given up) would be 36% lower in the quarter to March 2021 than in the previous quarter, and Cushman & Wakefield predicted a 50% drop.

Residential segment has far exceeded its 2020 levels, while office is straining to get there

Excessive Stock

Indian real estate sector stepped up on new launches due to the buoyancy in the residential phase. According to Anarock, the number of new homes entering the market increased 18% when compared to the December quarter. The larger cities of Mumbai, Pune, and Delhi NCR accounted for roughly 70% of those launches. Furthermore, according to Anarock, approximately 30% of launches were in the low-cost housing segment (price range of up to 40 lakh) and 43% were in the mid-range (price range of 40-80 lakh).

According to Anarock data, the combined stock of unsold homes in the seven primary markets increased 1 percent to 642,000 models, with new launches marginally exceeding gross sales for the quarter. The stock overhang encompasses a wide range of possibilities. It is 85 months in the Delhi NCR. In other words, at the current rate of internet absorption (gross sales minus new launches), clearing the inventory of unsold homes would take 85 months. It is 28 months in Bengaluru. Builders will be under pressure to carry costs as a result of new launches and stock overhang.

With new launches picking up, inventory levels across markets remains high

Value Stability

The previous year has been a buyer’s market. On the one hand, there is a glut of unsold homes, as well as a large pool of ready homes, which carry lower risks of possession. However, prices in six of the seven major markets have either remained stable or decreased. According to data from real estate portal 99acres.com, 30 percent of the 537 localities tracked by it across these seven markets saw prices fall in the March 2021 quarter compared to the March 2020 quarter. The value increase was only as much as 5% in an additional 43% of the areas.

Hyderabad was an exceptional case. Across all research reports, the March 2021 quarter showed the best progress in residential gross sales growth. Additionally, 99acres.com tracks price increases in 32 Hyderabad neighborhoods.

House prices fell, or rose only marginally, in all cities except Hyderabad

Sentiment Dip

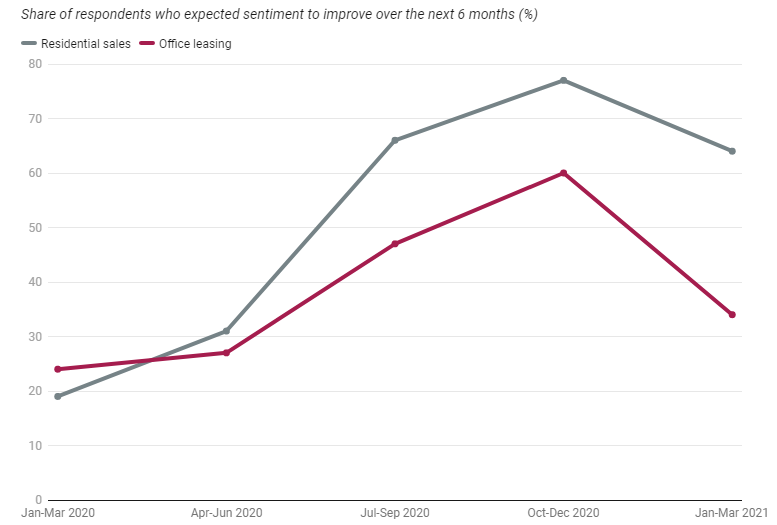

Looking ahead, sentiment in the residential area remains more positive than in the office phase. Knight Frank, Ficci, and Naredco surveyed a number of real estate stakeholders ahead of the next six months. In comparison, this figure for the workplace phase was only 34 percent. Each value has risen in the December 2020 quarter, and the gap between residential and workplace segments has narrowed.

ALSO READ: The residential segment will be shaped by emerging trends this year

Both residential and office segments are seeing a pullback in sentiment

This survey took place between the 31st of March and the 12th of April. Lockdowns have returned and intensified since then. Private offices have once more closed. Customer commitments to take on new space pushed even office deals in the March quarter. According to Cushman & Wakefield’s most recent report, “as occupiers continue to review, revise, and fine-tune their space strategies over the next 3-9 months, market activity may remain flat in the short term with limited deal closures.” For builders, the action remains in the residential sector.