Surge in Covid-19 cases may derail real estate from recovery path

Amid a dramatic increase in the number of new Coronavirus cases in India – the country recorded 3,48,529 new COVID-19 infections on May 12, 2021, bringing the total caseload to 2,33,40,938, while deaths from the virus increased to 4,200 on May 11, 2021. The highest daily toll recorded in India thus far – demand for residential real estate in India may be thrown off course, according to the head of industry body CREDAI.

India has the second-highest number of cases, with over 23 million, after the United States. Because of the increase in cases during the COVID-19 second wave, many parts of India, particularly Delhi, Maharashtra, Rajasthan, Odisha, and Gujarat, are now subject to restrictions such as partial lockdowns, weekend lockdowns, night curfews, and so on.

“We are concerned about the COVID-19 pandemic’s second wave. Providing migrant labour on site and logistical support will not cause a problem. In the event of a total lockdown or loss, (buyer) sentiment may suffer… Harsh Vardhan Patodia said at a virtual press conference that COVID-19 could act as a short-term dampener.

The demand for housing in India might also impact amid a change in stance in the banking system.

Despite the fact that India’s central bank decided to maintain the status quo on policy rates on April 7, 2021, public lender SBI increased its home loan interest rates by 25 basis points beginning in April, indicating that banks may be moving away from the current historically record low interest rate regime.

Developers believe that the Reserve Bank of India could have done better by reducing its recently announced monetary policy review.

Meanwhile, the massive increase in the number of Coronavirus cases has had an impact on India’s office markets as well. It is believed that the current situation caused a decrease in net leasing activity from January to March 2021. The quarter in these major cities saw Cushman and Wakefield’s net leasing activity decline by 48 percent; JLL India’s showed a 36 percent decline.

Housing affordability seen increasing

Indian real estate will reap the benefits of Coronavirus vaccinations as the immunisation campaign continues.

With the ongoing Coronavirus pandemic, Indian housing market sales and supply are expected to increase between January and March 2021.

There are currently loans available with rates as low as 6.65% annually, but the repo rate remains at 4%. This is in contrast to the January 2020 average home loan interest rate of 8%. Moreover, the impact on demand on housing prices has stifled price growth over the last year.

Property brokerage firm JLL India stated in a report titled ‘India Real Estate Outlook – A New Growth Cycle’ that new housing supply in 2021 would continue to be in the affordable and mid-segment, with developers attempting to capitalise on strong pent-up demand.

India’s growth forecast has been revised up by several agencies, possibly indicating an improved and faster housing market.

On March 24, 2021, Fitch Ratings revised India’s growth estimate for fiscal 2021-22 to 12.8 percent, up from its previous estimate of 11 percent, citing “a stronger carryover effect, a looser fiscal stance, and better virus containment.” Many other rating agencies and global think tanks, including Moody’s Analytics and the Organisation for Economic Co-operation and Development (OECD), have raised their forecasts for India’s growth, as the domestic immunisation programme against the virus gains traction.

It doesn’t seem like home sales will slow down in 2021 despite the improving economy and stable employment conditions.

Vaccine rollout to restore normalcy in India’s Corona-hit housing segment

The government of India has enlisted Pune-based Serum Institute of India Ltd, the world’s largest vaccine manufacturer by volume, to manufacture a billion doses of AstraZeneca’s Coronavirus vaccine, which began distribution across locations on January 12, 2021.

As India begins the race to vaccinate its over 1.3 billion people in mid-January, the positive impact of one of the world’s largest immunisation programmes will be seen in the country’s residential real estate sector, which employs the greatest number of unskilled workers.

With a massive vaccination drive underway, risks to the recovery may be reduced, and economic activity is expected to pick up in the second half of 2021, according to India’s banking regulator, the RBI, in its monetary policy statement on February 4, 2021. “Financial markets remain buoyant, aided by easy monetary conditions, ample liquidity, and optimism from the vaccine rollout. “With the rollout of the vaccine programme in the country, growth is recovering and the outlook has improved significantly,” RBI governor Shaktikanta Das said.

In the midst of anticipation for the launch of the inoculation programme, green shoots of revival have already emerged, as evidenced by quarterly housing sales and new supply figures.

Following a record low in the previous two quarters due to a dramatic increase in the number of infections – as of January 12, 2020, India had reported nearly 10.5 million COVID-positive cases and 1,51,000 deaths due to virus infection. According to a recent report by property brokerage firm PropTiger.com, home sales in India’s eight prime residential markets reached 58,914 units in the October-December 2020 period, representing a 68 percent quarterly increase. New supply data also showed a significant increase, with a 173 percent quarter-on-quarter (Q0Q) increase.

While this could be seen as the beginning of a full-fledged and slow but steady recovery process, much will depend on how efficiently Asia’s third-largest economy, with its limited health and transportation infrastructure, manages the daunting task of making the vaccine available to its large population in the face of supply-side concerns. The same factor would have an impact on the overall economic recovery scenario, which would then play a role in shaping the future of India’s residential realty segment. As a result, India’s economy is still in trouble.

Even in the best-case scenario, according to government projections, India’s GDP growth will contract by a record 7.7 percent during 2020-21, with the pandemic wreaking havoc on the manufacturing and services sectors.

According to World Bank Global Economic Prospects, India’s economy will contract by 9.6 percent in FY 2021, owing to a sharp decline in household spending and private investment. In 2021, growth expected to return to 5.4 percent. The International Monetary Fund predicts that India’s economy will contract by 10.3 percent in fiscal year 2021, before expanding by 8.8 percent the following year.

Indian housing market’s initial reaction to COVID-19

Since the Coronavirus struck the world in December 2019, a lot has changed. India’s growth forecast slashed as a result of measures taken by several countries to contain the pandemic.

The International Monetary Fund (IMF) said in its World Economic Outlook October 2020 report, titled ‘A Long and Difficult Ascent,’ that the Indian economy would grow at a -10.3 percent rate in 2020, a -5.8 percentage point downgrade from the agency’s June estimate.

Following the release of GDP figures for the first quarter of FY21, which showed a 23.9 percent decline over the same quarter the previous fiscal year, global rating agencies S&P, Moody’s, and Fitch forecasted the Indian economy to contract by 11.5 percent and 10.5 percent, respectively, in the current fiscal.

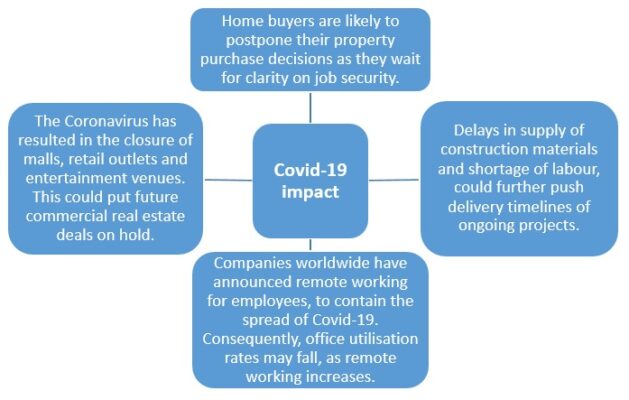

While the pandemic’s negative effects are already being felt around the world, differing perspectives are emerging on COVID-19’s impact on the real estate sector, a health emergency that forced the largest ever work-from-home experiment globally, calling into question the relevance of workspaces in a post-Coronavirus world.

In India, where economic contraction indicates a delayed start to the long and difficult road to recovery, a prolonged lockdown — which began on March 25, 2020, and was eventually extended until June 7, 2020, amid a dramatic increase in the number of infections — exacerbated the situation in Asia’s third-largest economy.

Research firms predict that real estate growth in India will slow down soon. Housing sales in India’s eight major cities fell by 66 percent between July and September 2020.

Tourism expected to grow strongly in the future due to the festival season.

Commercial growth in India is likely to stall even with a 27 percent increase in deal volume from 2018.

Any optimistic predictions about its growth made prior to the sudden onset of the global calamity have been retracted, as the government gets busy devising plans to prevent businesses in general and the economy in particular from sinking deeper into a slump, amid growing fears that the rupee will fall to a low of Rs 78 against the US dollar.

One thing is certain, however: India’s real estate sector will face short-term shocks as a result of the contagion.

COVID-19 impact on Indian housing market

Despite no price drop, the spread of Coronavirus has further delayed government measures aimed at boosting demand.

According to Niranjan Hiranandani, national president of NAREDCO, “salvaging Indian realty, the second-largest employment generator, is critical, not only from the perspective of GDP growth but also for job creation, because the sector has a multiplier effect on 250-plus allied industries.”

Home loan rates decreased earlier this month, as well as a Rs 25,000 crore stress fund to assist stalled projects

The residential demand slowdown has already slowed housing sales, project launches, and price growth in India’s residential realty sector, which has been under pressure from mega regulatory changes such as the Real Estate Regulatory Authority (RERA), the Goods and Services Tax (GST), demonetisation, and the benami property law.

The RERA reportedly allows developers to extend deadlines by six months if they experience delays in projects.

COVID-19 impact on home buyers in India

If low interest rates (home loan interest rates are now below 7%) and high tax exemption (rebate against home loan interest payment is as high as Rs 3.50 lakhs per annum) were going to change consumer behaviour, the Coronavirus outbreak is likely to put a stop to that change, at least in the short to medium term.

Property seekers who are unwilling or unable to conduct site visits may postpone purchasing decisions. In spite of economic and policy reforms taking place in India’s realty sector, the Coronavirus pandemic has caused worsened conditions. In addition to the slowdown, decision-making processes take a long time, and site visits are almost nonexistent.

Purchasing property would also suffer if businesses scale back until they know for sure their jobs are secure.

Despite the fact that the RBI has announced several rate cuts, bringing the repo rate down to 4%, any positive effect on buyer sentiment will be seen only in the medium to long term. An existing buyer may have difficulty repaying EMIs during a lockdown or job loss.

As a result, buyers have been recognizing the value of home ownership, and this has boosted residential property demand.

According to the survey, 52 percent of respondents said they will wait six months before buying a home. In order to work from home, nearly 33 percent of survey respondents said they would have to upgrade their homes. In a survey of renters, 47 percent said they would like to invest in property if it was affordable.

With the adoption of virtual tours, drone photos, video calls, and online booking platforms, our industry is becoming digitized rapidly. Some states may move to online property registration as real-estate technology plays a larger role in rentals and purchases. Some site visits may be replaced by online bookings in the future as buyers will increasingly use technology.

Coronavirus impact on builders in India

Slump-hit builders were pinning their hopes on government assistance to clear rising unsold stock, even as an ongoing crisis in the country’s non-banking finance sector, a key source of housing sector funding, made borrowing extremely difficult, jeopardising their plans to complete projects on time.

Developers were sitting on an unsold stock worth approximately Rs 6 lakh crores, as of September 2020. India remains under lockdown, but supplies from China are slowing down, delaying delivery timelines and causing overall costs to rise. China, the country where the virus originated, has been able to contain the pandemic, with workers returning to work. However, because of the tension between the two neighbours, builders in this area may have to postpone orders.

The government announced an EMI holiday during this critical period as part of its Coronavirus-specific stimulus package.

The pandemic threat has arrived at an especially sensitive time. This is the time of year when real estate companies make statutory payouts and streamline their balance sheets.

Coronavirus impact on office space in India

Even though people are gradually returning to work in industries where working from home is not an option, remote working remains the primary mode of operation for businesses for the time being.

India handled the workplace shift very well during the lockdown and has continued to do so despite the limited re-opening. Workplaces will become ecosystems driven by locations and experiences to promote convenience, functionality, and wellbeing.

Previously, as the number of infections increased dramatically, companies around the world announced remote working for employees in order to contain the virus’s spread, sparking a debate about whether work-from-home could eventually replace office spaces. Despite the mystery surrounding remote working, short-term tremors are inevitable in India’s commercial real estate segment.

The virus’ impact on office space is also affecting developers, despite better liquidity access and lower default risk. The pandemic forced corporations and co-working companies to postpone expansion plans over seven major cities. Office space has expanded across seven cities, including Delhi-NCR, Mumbai, Kolkata, Chennai, Pune, Hyderabad, and Bengaluru. During the January-September 2020 period, net office space leasing fell by 47 percent to 17.3 million square feet, down from 32.7 million square feet in the same period in 2019. the remote working concept contributed to the fall in demand for office space, Increased office space consolidation and optimisation strategies of corporate occupiers, resulted in subdued net absorption levels, which could not keep pace with new completions. This resulted in overall vacancy increasing from 13.1% in Q2 2020 to 13.5% in Q3 2020.

In 2019, gross office space absorption increased by nearly 30 percent compared to 2018, but this was too little. By the end of 2020, office stock in seven major cities expected to exceed 660 million square feet.

COVID-19 impact on mall developers in India

In India, a total of 54 malls will open in 2020. These projections, however, occurred before the Coronavirus pandemic. Only five new malls opened in Gurugram, Delhi, Bengaluru, and Lucknow due to these limitations. This also reflects the state of the retail sector in India.

Indian mall footfall dropped by half due to fear of the virus spreading. Even though the government has lifted restrictions, allowing malls to operate under strict rules, this segment continues to suffer.

Low footfall and subsequent mall closures will have an impact on developers’ debt servicing for the project. Even a short-to-medium-term relaxation from banks should not have a significant impact. Debt servicing difficulties may persist as long as the virus scare goes on for more than one to two quarters.

Footfalls will eventually return to normalcy as people regain confidence to throng public places in large numbers. This will also result in a fundamental shift in how mall owners view their properties. People will return to their malls if there is a greater emphasis on air quality, hygiene and sanitisation, and awareness.

Coronavirus, which closed retail outlets, malls, and entertainment and fitness centres, has put a halt to commercial real estate deals.

In the face of rising vacancy rates in shopping malls, mall operators will need to act prudently.

COVID-19 impact on warehousing in India

The fact that e-commerce projected to grow significantly in the post-Coronavirus world favors India’s warehousing industry. More importantly, this expansion will not only affect major cities, but will also affect smaller towns.

The available warehouse space in 2020 estimated to be 12 million square feet, rather than 45 million. With demand increasing in the long term, it is possible to add 30-35 new tier-2 and tier-3 cities.

ALSO READ: Residential real estate demand surpasses pre-Covid levels

Outlook for Indian real estate in 2021

While the pandemic affected the sector severely in 2020, in 2021 things will be better. Buying a home is becoming increasingly important for buyers as well as investors in the coming year.

A structural re-imagining of strategies from all sectors is necessary in these extraordinary times to ensure a sustained recovery. New, transformational approaches require influx of investors and widespread adoption of technology.